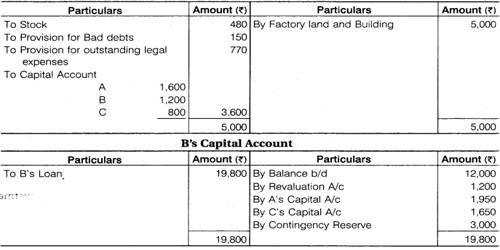

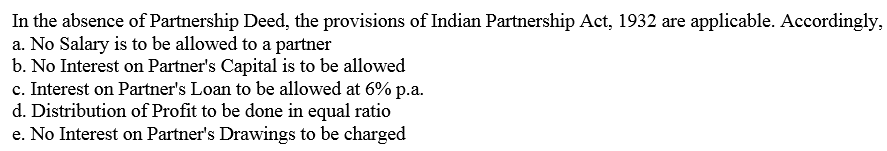

X, Y and Z are partners in a firm sharing profits in 2 2 1 ratio The fixed capitals of the partners were X ₹5,00,000; 21 In the absence of Partnership deed, partners are entitled to interest on capital F 22 Interest on loan advanced by a partner to the firm shall be paid even if there are losses in the business T 23 Under Fixed Capital method, any addition to capital will be shown in Partner's Capital AccountT 24Interest On Capital Should Not Be Allowed (B) In The Absence of The Partnership Deed, No Salary Will Be Allowed Hence, B And C Are Correct Interest on Capital Should Not Be Allowed As per principle Interest on partner's loan will be allowed at 6% pa So, In this situation A and B are correct C should be allowed Interest on loan @ 6%

Class 12 Accounts Fundamental Of Accounts Notes

In absence of partnership deed the interest is allowed on partners capital

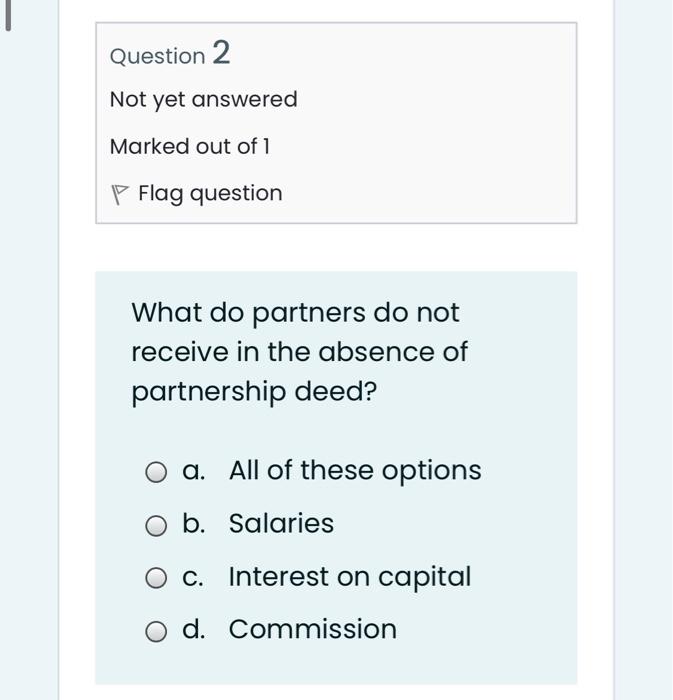

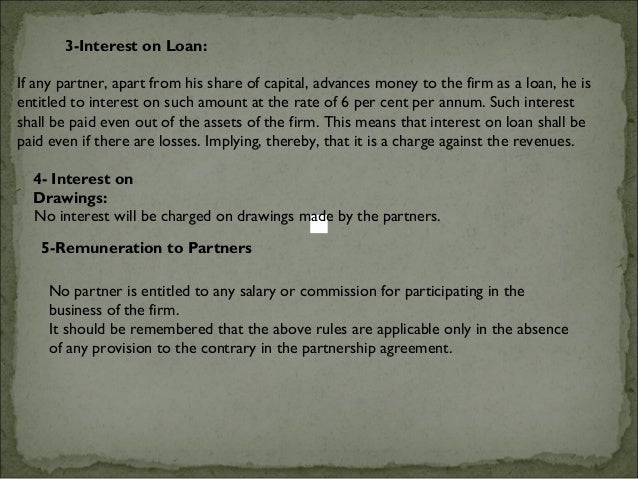

In absence of partnership deed the interest is allowed on partners capital- Aug 24,21 In the absence of any deed of partnershipa)Interest at the rate of 6% is to be allowed on a partner's loan to the firmb)Partners are entitled for commission @ 6% of the net profits of the firmc)Partners contributing highest capital is entitled for interest on capital @ 6% pad)Only working partners are entitled to SalaryCorrect answer is option 'D' provision in the absence of partnership deed (a) salaries to partners No salary will be allowed to partners (b) Interest on partners No interest will be allowed to partners on their capital (c) Interest on partner loan 6% pa interest will be allowed on the money given by parters to the firm in the form of loans and advances (d) Distribution of profit

Class 12 Accounts Fundamental Of Accounts Notes

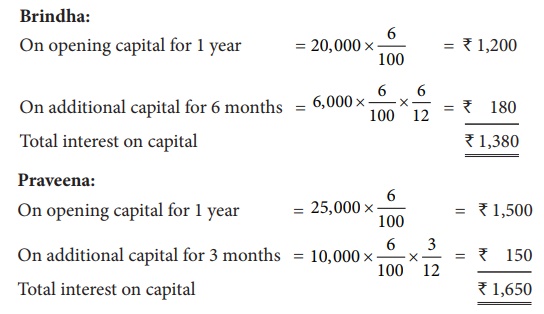

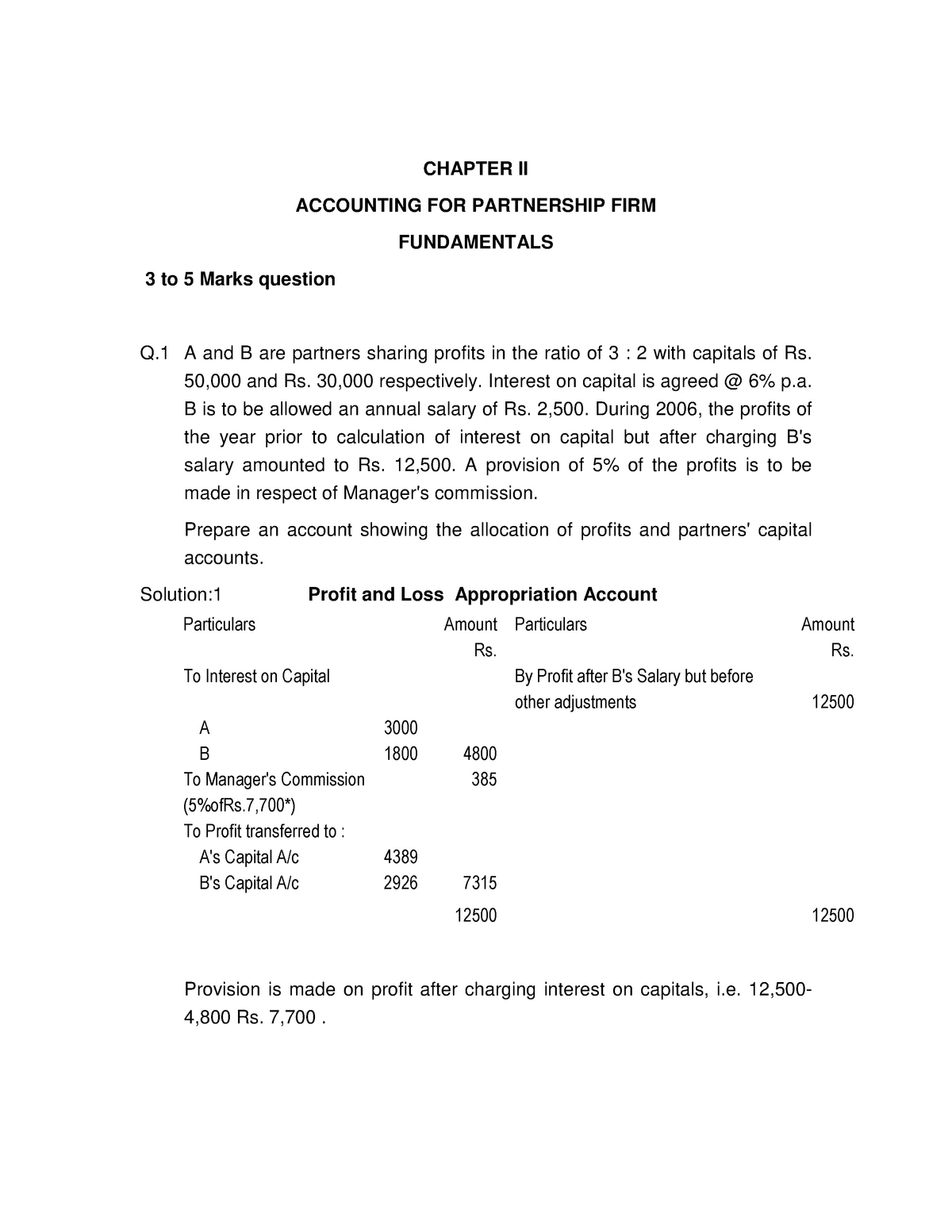

Important Guidelines in the absence of the Partnership Deed Following are the important guidelines or rules to be followed by the partners in case there is no partnership deed prepared by the partners Profitsharing Ratio Equal, irrespective of the partners' capital contribution Interest on capital is allowed on the Opening Capital of when capital contribution by the partners varies (D) when the partner's salary and interest on capital are not incorporated in the partnership deed Answer Answer A 18 In the absence of Partnership Deed, the interest is allowed on partner's capital (CPT;Calculate the interest to be paid on the capital fACCOUNTING FOR PARTNERSHIP — BASIC CONCEPTS 21 Solution Statement showing calculation of interest Particulars Mansoor Reshma Rs Rs 1 Interest on capital balance on Mansoor – (,000×6/100) 1,0 Reshma – (15,000×6/100) 900 2

In the absence of partnership deed or verbal agreement, or if the partnership deed is silent on a certain point, the following provisions of the Indian Partnership Act, 1932 will be applicable PROFIT SHARING RATIO Profits and losses are to be shared equally irrespective of their capital contribution INTEREST ON CAPITAL No interest onIn the absence of partnership deed, partners share profits or losses In the ratio of their Capitals In the ratio decided by the court Equally In the absence of Partnership Deed, the interest is allowed on partner's capital @ 5% pa @ 6% pa @ 12% pa No interest is allowed 26 In the absence of agreement, partners are not entitled to Interest on partners loan It is a charge against profits It is provided irrespective of profits or loss It will also be provided in the absence of Partnership Deed @ 6% per annum The following entries are passed to record the interest on partner's loan For allowing Interest on loan Interest on Partner's Loan A/c Dr

The partnership deed provided that interest on partners' capital will be allowed @ 10% per annum The same was omitted (ii) P, Q and R were partners Sep 28,21 In the absence of any deed of partnershipa)Only working partners are entitled to Salaryb)Partners are entitled for commission @ 6% of the net profits of the firmc)Partners contributing highest capital is entitled for interest on capital @ 6% pad)Interest at the rate of 6% is to be allowed on a partner's loan to the firmCorrect answer is A partnership deed provides for the payment of interest on capital but there was a loss instead of profits during the year 1011 Will the

107 A Rules Applicable In The Absence Of Partnership Deed Accountancy Class 12 Youtube

Class 12 Accounts Fundamental Of Accounts Notes

Their respective fixed capitals were Rs 10,00,000 and Rs 6,00,000 The partnership deed provided interest on capital @ 12% pa The Partnership deed further provided that interest on capital will be allowed fully even if it will result into a loss to the firm The net profit of the firm for the year ended 31 st March, 18 was Rs 1,50,000Partnership Deed Meaning Written document containing all the terms and conditions of Partnership Rules in the Absence of Partnership Deed Issues Provision 1 Salary/Commission to Partners No 2 Interest on Capital No 3 Interest on Drawings No 4 Interest on Partner's Loan 6% 5 Profit Sharing Ratio Equal Question 1Mahesh wants that interest on capital should be allowed to the partners but Ramesh and Suresh do not agree As per Partnership Act, if there is no partnership agreement among partners regarding interest on capital no interest on Capital will be allowed

Class 12 Accounts Fundamental Of Accounts Notes

Question 1 Not Yet Answered Marked Out Of 1 P Flag Chegg Com

18 In the absence of Partnership Deed, the interest is allowed on partner's capital (CPT;Interest on Capital is to be paid to partners only if it is specifically agreed upon If there is no mention regarding this, in the partnership agreement (deed), then no In the absence of partnership deed, no interest in allowed on capital and no interest is charged on drawings Answer 11 – c) No interest will be allowed and charged Explanation 12In the absence of partnership deed, each partner gets equal share in profit, no matter how much contribution made by him including sleeping partner

Page 17 Ma 12

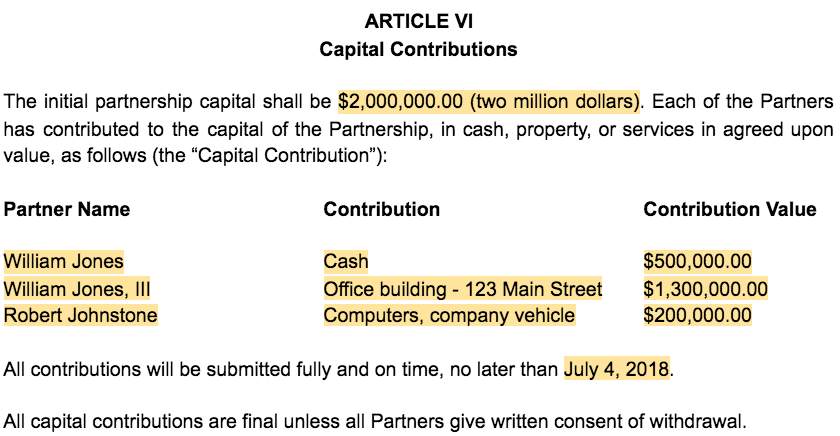

Date Of Commencement Of Partnership 4 Capital Contributed By Each Partners 5 Course Hero

Accounting rules applicable in the absence of Partnership deed Normally, a partnership deed covers all matters relating to mutual relationship among the partners But, in the absence of agreement, the following provisions of the Indian Partnership Act, 1932 shall apply for accounting purposes 1 Interest on Capital No interest is allowed on Capitals of the Partners If In the absence of partnership deed, interest on capital will be given to the partners at (b) 6% pa (d) None of these (b) Real Account (d) None of Interest on capital – No interest on capital will be allowed to the partners Interest on drawings – No interest on drawings is charged from the partners Interest on Loans – Interest @ 6% pa is to be allowed on the loan given by the partners to the firm

In The Absence Of Specific Provision In The Partnership Deed At What Rate Interest On Drawing Of The Partners Would Be Allowed

No Partnership Deed Exist Absence Of Partnership Deed Partners A And B Have Contacted You To Solve Brainly In

In the absence of Partnership Deed, the interest is allowed on the loan given by the partners to the firm— (a) 9% per annum (b) 8% per annum (c) 6% per annum (d) 5% per annum 5 In the absence of Partnership Deed, the interest is allowed on the capital of the partner— (a) No interest is allowedAnswer No interest on capital will not be allowed in case of a loss Provisions Applicable in the Absence of Partnership Agreement/Partnership Deed Interest is not allowed on Partners' Capitals;

Www Capitalcoaching In

Ts Grewal Solutions For Class 12 Accountancy Accounting For Partnership Firms Fundamentals Accountancy

In the absence of a partnership deed, profits of the firm will be shared by the partners in (a) Equal ratio (b) Capital ratio asked in Accounts of Partnership FirmsFundamentals by Vijay01 ( 502k points) If partnership deed silent, interest allowed on partner capital account will be 14 The maximum number of partner in case of nonbanking partnership firm is 15 In the absence of an agreement, interest on partner loan shall be paid @ 16 The written form of partnership agreement is call as 17In the Absence of Partnership Deed, Interest on a Loan of a Partner is Allowed (1) at 8% per Annum (2) at 6% per Annum (3) No Interest is Allowed (4) at 12% per Annum Accountancy

Singh Education Centre Photos Facebook

Jaspal And Rosy Were Partners With Capital Contribution Of Rs 10 00 000 And Rs 5 00 000 Respectively They Do Not Have A Partnership Deed Jaspal Wants That Profits Of The Firm Should Be Shared

The maximum number of Partners allowed in a partnership firm are __ Answer 50 In the absence of Partnership Deed, interest on loan of a partner is allowed (a) at 8% per annum (b) at 6% per annum At what rate will the interest on capital be allowed ? 13 In the absence of partnership deed, partners, are not entitled to receive (A) Salaries (B) Commission Interest on Capital D) All of these AnswerAll of these 14 If a fixed amount is withdrawn on the first day of every quarter, the interest on total drawings will be calculated for— (A) For 6 months (B) For 65 months For 55 months1 Profit sharing Ratio Profits and losses would be shared equally among partners 2 Interest on capital No interest on capital would be allowed to partners If there is an agreement to allow interest on capital it is to be allowed only in case of profits 3 Interest on drawings No interest on drawings would be charged from partners 4

Ts Grewal Solutions For Class 12 Accountancy Accounting For Partnership Firms Fundamentals Accountancy

A B C Are Partners In A Firm They Have No Partnership Agreement For Their Guidance At The End Of The First Of The Commencement Of The Firm Sarthaks Econnect

Partnership deed is a document in writing that contains the terms of the agreement among the partners It is not compulsory for a partnership to have a partnership deed as per the Indian Partnership Act, 1932 But, it is desirable to have a partnership deed as it serves as an evidence of the terms of the agreement among the partners(b) Interest on Capital No partner is entitled to claim any interest on the amount of capital contributed by him in the firm as a matter of right However, interest can be allowed when it is expressly agreed to by the partners Thus, no interest on capital is payable if the partnership deed is silent on the issue 1 when partnership deed does not provide interest on capital a) interest on capital is not allowed 2 when partnership deed provides for interest on capital but is silent on whether it is charge or appropriation b) interest on capital is allowed in all circumstances c) interest on capital is allowed if only profit is their

2jnomj8w4bzlom

Bishopscottboysschool Com

Y ₹ 5,00,000 and Z ₹ 2,50,000 respectively The Partnership Deed provides that interest on capital is to be allowed @ 10% pa Z is to be allowed a The document which contains the terms and conditions of partnership is called Partnership is called Partnership Deed 10 In the absence of a specific agreement, interest on capital is paid only out of profit 2 Interest on capital No interest on capital would be allowed to partners If tehre is an agreement to allow interest on capital it is to be allowed only in case of profits 3 Interest on drawings No interest on drawings would be charged from partners 4 Salary No salary or commission is to be allowed to partners 5 Interest on Loan If apartner has provided any Loan

Partnership Deeds Meaning Contents With Solved Questions

Class 12 Accountancy Part 19

In the absence of a partnership deed, the following rules have to be followed 1 The partners are entitled to share the profits or losses equally 2 Partners are not entitled to interest on their capital 3 No partner will be allowed salary, or any other Applications of the provisions of the Indian Partnership Act, 1932 in the absence of partnership deed Remuneration to partners No salary or remuneration is allowed to any partner Section 13(a) Profitsharing ratio Profit and losses are to be shared by the partners equally Section 13(b) Interest on capital No interest is allowed on the In the absence of a Partnership Deed, or if the Partnership Deed is silent on a certain point, the following provisions of partnership Act, 1932 will be applicable Profit and losses are to be shared equally irrespective of their capital contribution

D Asset Account Ne On Dissolution Partners Loan Is Transferred To A Partners Capital Account By

Cyd Tutorials Sarika Coaching Center Learn And Grow Facebook

Itis allowed only when there is profit and it is provided before division ofprofits among the partners No interest is allowed on the capitals of partners,if it is not specifically mentioned in the partnership deed When the firm incursloss, interest on capital will not be provided (a) Interest on partners capital (b) Interest on partners drawings (c) Interest on partners loan (d) Partners' profit sharing ratio (e) Salaries of partners Answer In the absence of partnership deed the provision affecting of Indian partnership act, 1932 are applicable the important rules are as follows (a) Interest on partners capital Reasons In the absence of any partnership deed, No partner is allowed to take interest on capital, salary and commission etc however only interest on loan is allowed at the rate of 6% pa and profit sharing ratio should be equal Question 5 Rakhi and Shikha are partners in a firm, with capitals of Rs 2,00,000 and Rs 3,00,000 respectively

Docshare01 Docshare Tips

Accountancy Test No 6 Class 12th Commerce With Nikhil Guru Facebook

June 11) (A) @ 5% pa (B) @ 6% pa @ 12% pa (D) No interest is allowed Answer Answer DX, Y and Z are partners in a firm sharing profits in 2 2 1 ratio The fixed capitals of the partners were X ₹5,00,000;Provisions Applicable in the Absence of Partnership Agreement/Partnership Deed 1 Interest is not allowed on Partners' Capitals or charged on Drawings 2 Partner is not entitled to salary or remuneration for the work done for the firm 3 Interest @ 6% pa is allowed on the loans advanced by any partner 4

2 Mahesh Ramesh And Suresh Are Partners In A Firm They Do Not Have A Partnership Deed At The End Brainly In

Mention Any Four Provisions Of The Partnership Act In The Absence Of Partnership Deed Business Studies Nature And Significance Of Management Meritnation Com

June 11) (A) @ 5% pa (B) @ 6% pa @ 12% pa (D) No interest is allowed Answer Answer D 19 In the absence of a partnership deed, the allowable rate of interestY ₹ 5,00,000 and Z ₹ 2,50,000 respectively The Partnership Deed provides that interest on capital is to be allowed @ 10% pa Z is to be allowed a salary of ₹ 2,000 per monthIn the absence of a partnership deed, the provisions of the Indian Partnership Act, 1932, apply According to the Act, if there is no agreement regarding the interest on capital contributed by the partners, then no interest on capital is allowed to any of the partners

/GettyImages-1152013583-a5bad8090c064339bf7880b7c9012379.jpg)

Which Terms Should Be Included In A Partnership Agreement

Plus Two Accountancy Chapter Wise Questions And Answers Chapter 2 Accounting For Partnership Basic Concepts A Plus Topper

b) Where there is a partnership deed but there are difference of opinion between the partners c) When capital contribution by the partners varies d) When the partner's salary and interest on capital are not incorporated in the partnership deed Ans – a) In the absence of Partnership Deed, the interest is allowed on partner's capital aInterest is not charged on drawings Partner is not entitled to salary or remuneration for the work done for the firm Interest @ 6% pa is allowed on the loans by any partner

Accounting For Partnership Firms Fundamentals Part 1 Notes Edurev

In The Name Of God

Cbse Class 12 Interest On Partner S Capital Offered By Unacademy

1

All You Need To Know About The Indian Partnership Act 1932

Commerce Guru Home Facebook

Freehomedelivery Net

Ts Grewal Solutions For Class 12 Accountancy Accounting For Partnership Firms Fundamentals Indianexpresss In

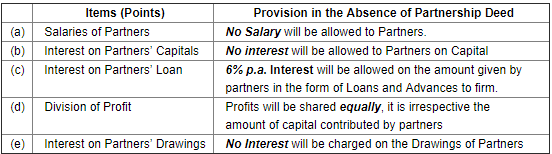

E14 6 New Partner Admission Purchase Of Existing Chegg Com

Updates On The Indian Partnership Act 1932 Amp E Compliance

Cbse Class 12 Accountancy Accounting For Partnership Firms Fundamentals Notes Concepts For Accountancy Revision Notes

Sgs 4 Partnership Agreements Business Law Lpc7302 u Studocu

3

Partnership Accounting

Class 12 Accounts Fundamental Of Accounts Notes

Partners Loan Account With Interest Thereon Assignment Point

Free Partnership Agreement Create Download And Print Lawdepot Us

Partnership Accounting

Pankaj Wadhwani S Commerce Classes Is At Pankaj Wadhwani S Commerce Classes Facebook

Remuneration To Partners In Partnership Firm Under 40 B

Ts Grewal Accountancy Class 12 Solutions Chapter 1 Accounting For Partnership Firms Zoefact

8 Key Components Of Accounting Firm Partnership Agreements And Other Special Considerations Levenfeld Pearlstein Llc

Class 12 Accounts Fundamental Of Accounts Notes

Udaylakhani Images Prof Uday Lakhani Sharechat ભ રતન પ ત ન ભ રત ય સ શ યલ ન ટવર ક

Ravi And Tiku Are Partners In A Firm According To Their Partnership Deed I Interest On Capital Will Be Allowed 5 Per Annum Sarthaks Econnect Largest Online Education Community

Partnership Deed Q 1 Q 6 Ch 2 Ts Grewal S 21 Class 12th

Rights And Responsibilities Of Partners In A Partnership Firm Legalwiz In

How To Create A Business Partnership Agreement Free Template

Partnership Deed Meaning Format Registration Stamp Duty

Calculation Of Interest On Capital Accounts Of Partnership Firms Fundamentals Accountancy

1

Accounting For Partnership Notes Class 12 Accountancy

Interest On Capital

X And Y Started Business On 1st April 18 With Capitals Of Rs 5 00 000 Each As Per The Partnership Deed Bth X And Y Are To Get Monthly Salary Of Rs

Basic Concept Sole Proprietorship Business Forms Of Business Partnership Joint Hindu Family Business Cooperative Society Company Ppt Download

In The Absence Of Partnership Deed How Are The Following Matters Resolved 1 Interest On Loan By Partner S And Accountancy Accounting For Partnership Basic Concepts Meritnation Com

2nd Puc Accountancy Question Bank Chapter 2 Accounting For Not For Profit Organisation Kseeb Solutions

Calculation Of Interest On Capital Accounts Of Partnership Firms Fundamentals Accountancy

Study Materialworkshop 16 Pdf Debits And Credits Goodwill Accounting

Ts Grewal Solutions For Class 12 Accountancy Accounting For Partnership Firms Fundamentals Cbse Tuts

Visionglobalschool In

Www Ggpsbokaro Org

Ts Grewal Solutions Archives Page 3 Of 5 Ncert Books

Www Aspirationsinstitute Com

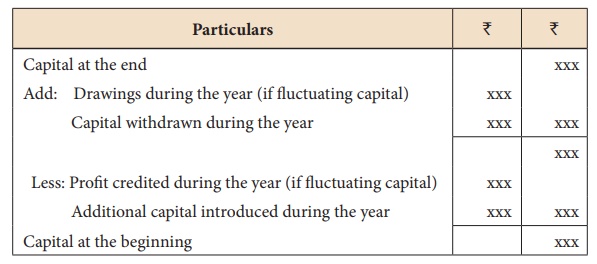

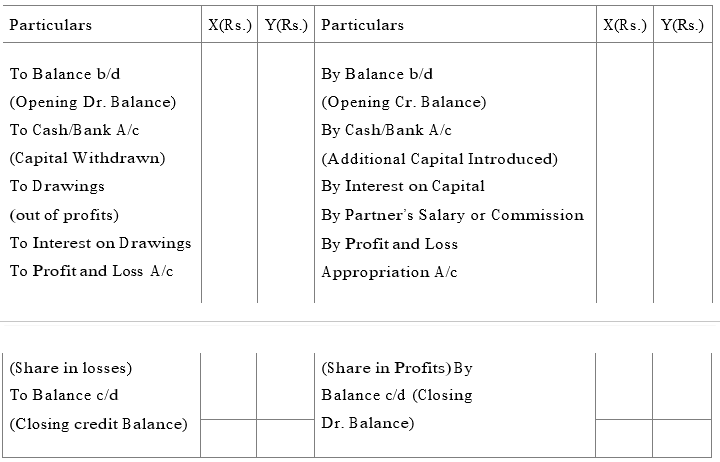

Accountancy Practical Oriented Questions Section D 1 Prepare Opening Statement Of Affairs With 5 Imaginary Figures 2 Prepare Capital Accounts Of Two Partners Under Fluctuating Capital System With 5 Imaginary Figures 3

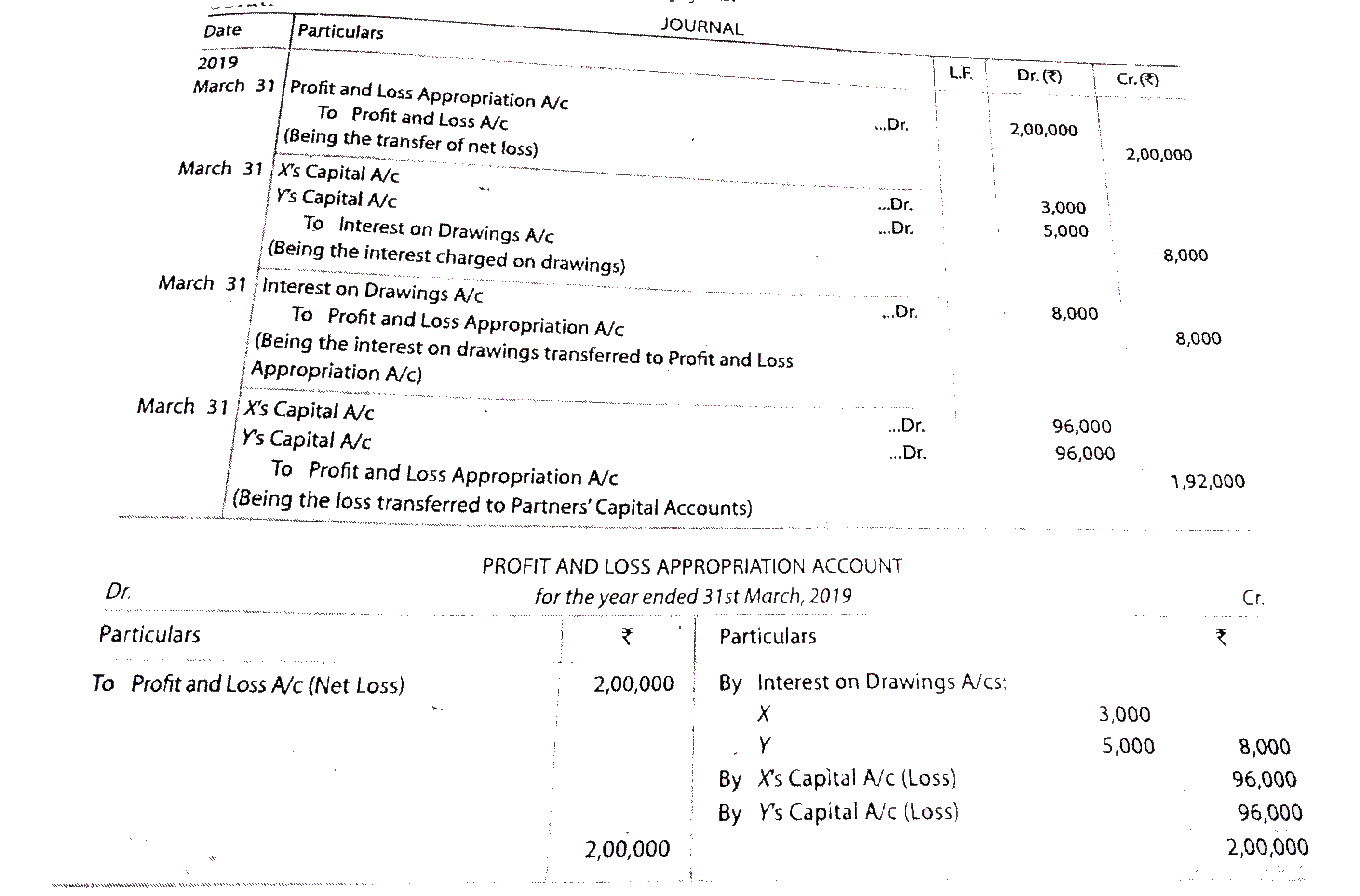

Profit And Loss Appropriation Account Template Pdf Chapter 1 Accounting For Partnership Basic Studocu

Accounting For Partnership

Partnership Definition Features Advantages Limitations

Profit And Loss Appropriation Account Accountancy Knowledge

Profit And Loss Appropriation Account Accountancy Knowledge

Class 12 Accounts Fundamental Of Accounts Notes

Partnership Deed Q 1 Q 6 Ch 2 Ts Grewal S 21 Class 12th

Partnership Accounting Sample Questions Iba Studocu

Partnership Agreements For Farmers Agri Businesses And Food Entrepreneurs Rincker Law Pllc

Types Of Partners In Partnership Business Rights Duties Liabilities Of Partners

Ts Grewal Solution Class 12 Chapter 2 Accounting For Partnership Firms Fundamentals 19

Doc Chapter 2 Accounting For Partnership Basic Concept Remedial Material Kelvin John Ramos Academia Edu

Ravi And Tiku Are Partners In A Firm According To Their Partnership Deed I Interest On Capital Will Be Allowed 5 Per Annum Sarthaks Econnect Largest Online Education Community

Myncert Com

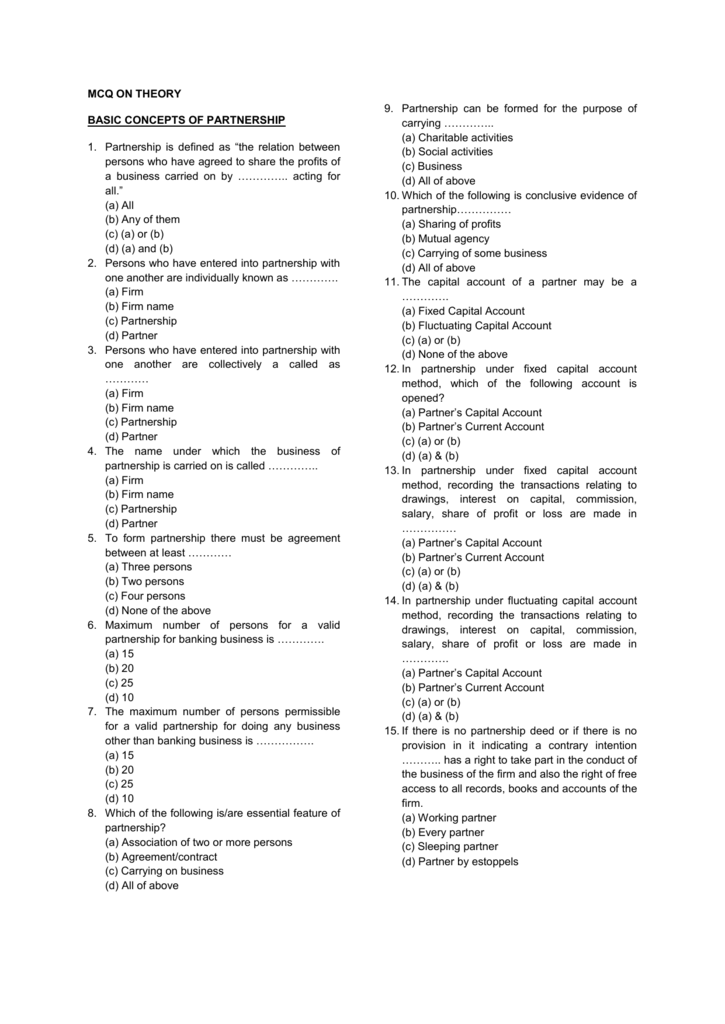

Mcq On Basics Of Partnership Multiple Choice Questions And Answers Partnership Accounts Mcqs Cma Mcq

Interest Remuneration To Partners Section 40 B

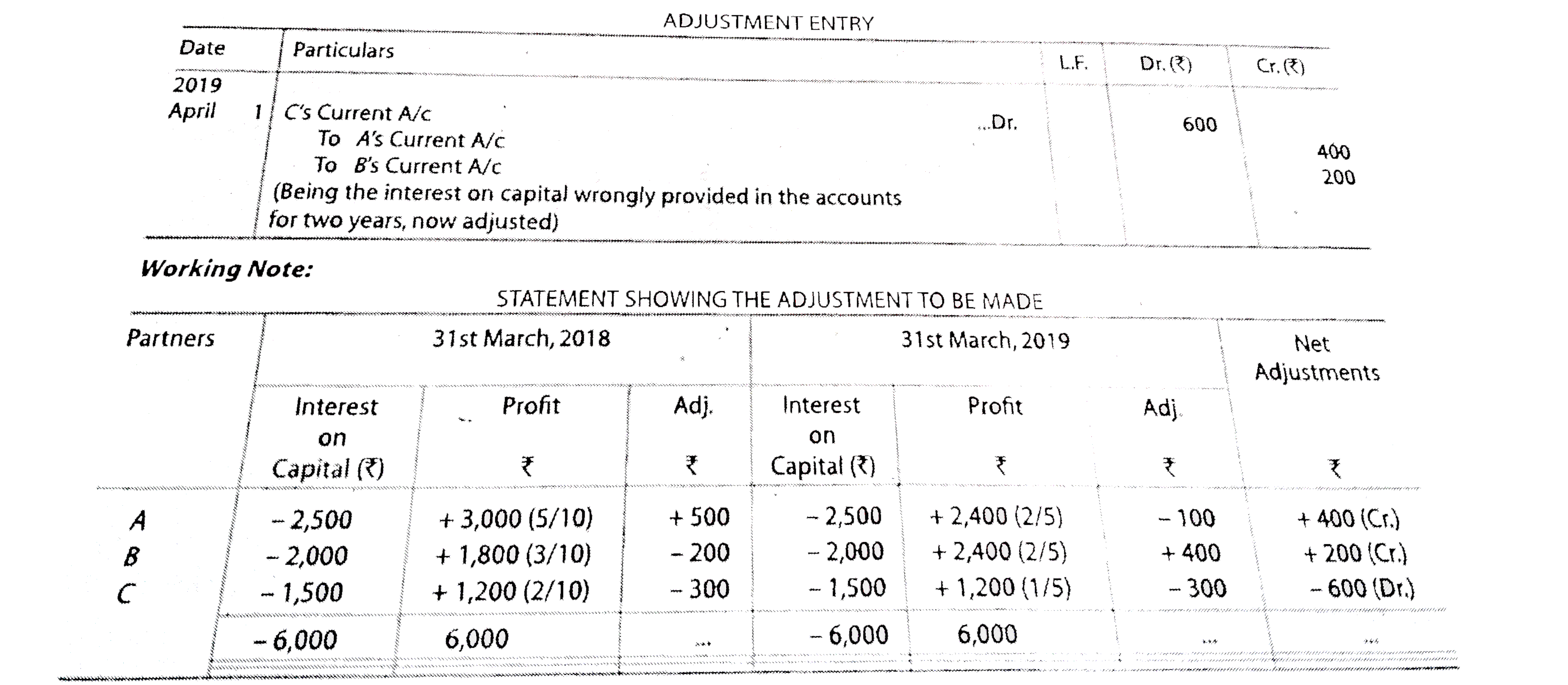

A B And C Are Partners In A Firm Partnership Deed Does Not Provides For Interest On Capital Still It Was Caredited To Partners Capital Accounts 5 P A For The Two

Solved Paragraph Ram And Shyam Were Partners In A Firm The Partnership Agreement Provides That 1 Profit Sharing Ratio Will Be Quot 3 Il Ra Course Hero

Partnership Fundamentals Objective Type Mission Accountancy

Profit And Loss Appropriation Account Accountancy Knowledge

Kendriya Vidyalaya Sangathan Partnership Deed Is A Written Agreement Among The Partners Which Contains The Terms Of Following Circumstances A Partnership Firm May Be Reconstituted

Important Questions For Cbse Class 12 Accountancy Profit And Loss Appropriation Account

Accounting For Partnership Notes Class 12 Accountancy

Partnership Accounts

Partnership Deed Its Importance And Rights Of Partners Accounting Finance

Plus Two Accountancy Chapter Wise Questions And Answers Chapter 2 Accounting For Partnership Basic Concepts A Plus Topper

Extwprlegs1 Fao Org

Faqs On Limited Liability Partnership In India Lexology

Free Partnership Agreement Template Create A Partnership Agreement

Www Cambrianpublicschool Com

Basic Concepts Partnership Deed Pt 2 Youtube

Page 30 Debk Vol 1

Partnership Accounting

0 件のコメント:

コメントを投稿